By Patrick J. Mahoney

During the 19th century, a number of insurance companies established their headquarters in the city of Hartford, earning it the nickname, the “Insurance Capital of the World.” As time went on, the presence of insurance giants became vital to the social, economic, and political fabric of the capital city. One of the most successful insurance companies to emerge during this period was Aetna. Over time, Aetna, whose headquarters still reside in Hartford, emerged as the nation’s largest health insurer. It remains one of the local area’s leading employers.

The Aetna Fire Insurance Company

In the spring of 1819, a number of prominent Hartford businessmen and merchants at Morgan’s Exchange Coffee House became embroiled in a heated discussion regarding the efficiency and practicality of the state’s fire insurance industry. It was this exchange at the popular State Street social spot that sowed the seeds for what eventually became the Aetna Fire Insurance Company, and later, Aetna Inc.

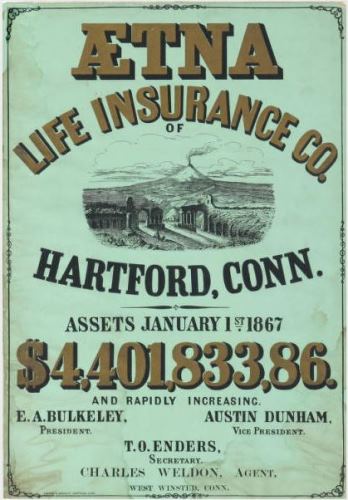

Advertisement for the Aetna Insurance Company, Hartford, 1828 – Connecticut Historical Society

After deeming Connecticut’s existing fire insurance companies insufficient to meet the demands of the commercial expansion in the state’s cities, 137 business and social leaders from the Hartford area, led by Thomas K. Brace, drew up a petition to establish a new insurance company. The petition outlined the fragility of the state’s existing insurance industry, noting, “It is presumed that each of the existing offices have undertaken risques to an amount greater than the capital of them all, and should a conflagration take place, in some of our towns, as disastrous as has been experienced in many places, it is greatly to be feared many of the sufferers would too late discover their insecurity.”

The first sign that the 1819 petition made an impact in the state legislature appeared in a May issue of the Hartford Courant, which noted that legislators formed a committee to consider the petition’s assertions. Its next public mention came in a Courant report, announcing the passing of a bill “to incorporate the Aetna Insurance Company” at the June 5 legislative session. It noted that founders chose the name “Aetna” in reference to the famous volcanic mountain on the east coast of Sicily, which “though surrounded by flame and smoke is itself never consumed.”

The Great New York City Fire of 1845

Aetna Life Insurance Co. of Hartford, Conn. assets January 1st, 1867 by Kellogg & Bulkeley – Connecticut Historical Society

Almost immediately, the Aetna Fire Insurance Company challenged its competitors for supremacy in a competitive, yet unstable, market. On a hot summer morning in 1845, however, the fortunes of the young company took a drastic turn. An unidentified boat captain arrived in Hartford from New York City and entered the Aetna offices (then located on State Street) frantically announcing that New York City was completely engulfed in flames. Summing up a near apocalyptic scene to his listeners, he noted, “the whole lower part of the city was covered with thick clouds of smoke through which we could see angry tongues of flame, seemingly in a dozen places at a time. Never did I hear such a clanging of fire bells; we could see at various points crowds of people running frantically up the streets; the city was in a tumult; and we heard men on the docks calling out that New York was doomed this time!”

Aetna president Thomas K. Brace hastily made his way down to assess the damage and estimate losses. Upon returning to Hartford, he called a meeting of the company’s board of directors. After acknowledging that the company’s resources and capital were almost completely exhausted by customer losses from this catastrophic event, he quickly endorsed various notes and sent them to banks to be discounted. With this quick and decisive action, the company managed to pay all of its customers’ claims. Although the event nearly proved disastrous to Aetna’s financial future, the manner in which Aetna managed their claims solidified its reputation as a sound and reliable insurance company.

This reputation soon spread, not just through the northeast but throughout the entire nation—made physically evident by the many small tin Aetna signs placed on the front of public and private buildings across the country. The presence of these signs, in highly visible places, not only conveyed protection by the emerging Connecticut insurance power, but also reinforced and spread Aetna’s reputation for safety, reliability, and prompt payment.

Entering the Life Insurance Business

In May of 1820, nearly a year after the first calls for the formation of a new fire insurance company, Aetna’s board of directors again voted to send a petition to the state legislature— this time seeking a charter amendment to permit the writing of life insurance. The expansion was a bold move given the stance of many religious leaders that assigning monetary value to one’s life was an immoral practice. Once approved by the legislature, however, the board voted to set aside an additional $50,000 of stock for the life insurance venture.

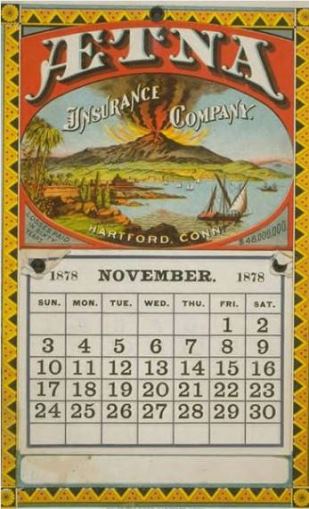

Aetna Insurance Company calendar by Bingham & Dodd, 1878 – Connecticut Historical Society

As the company continued to expand (now in two directions), the unique business demands of fire underwriting and life insurance became increasingly clear. Thus, the board of directors petitioned the legislature again in 1853, this time seeking to amend the charter to separate the life insurance department from the parent company. The stockholders of the “Annuity Fund” now constituted a new corporation under the name “the Aetna Life Insurance Company,” with Eliphalet A. Bulkeley as its first President.

Thriving in the “Insurance Capital of the World”

As time progressed, Aetna continued to adjust its areas of focus to meet consumer concerns and demands. Such innovations included the introduction of an accident and liability department to appeal to the increased focus upon labor rights and unions in the early 20th century, and the creation of an automobile insurance company in 1913 to meet societal concern in an age of increasing mobilization. Additionally, as the company’s success grew so, too, did its geographic range. In 1960, Aetna entered the international arena when it acquired the Canadian company, Excelsior Life Insurance. In the decades that followed, the international expansion continued with the company investing in ventures throughout Europe, Asia, and Latin America. Today, the company that started as a small cadre of local businessmen concerned about the state of the local fire insurance market enjoys success as a globally renowned member of the Fortune 100, dealing primarily in health insurance.

Patrick J. Mahoney is a Research Fellow in History & Culture at Drew University and former Fulbright scholar at the National University of Ireland Galway